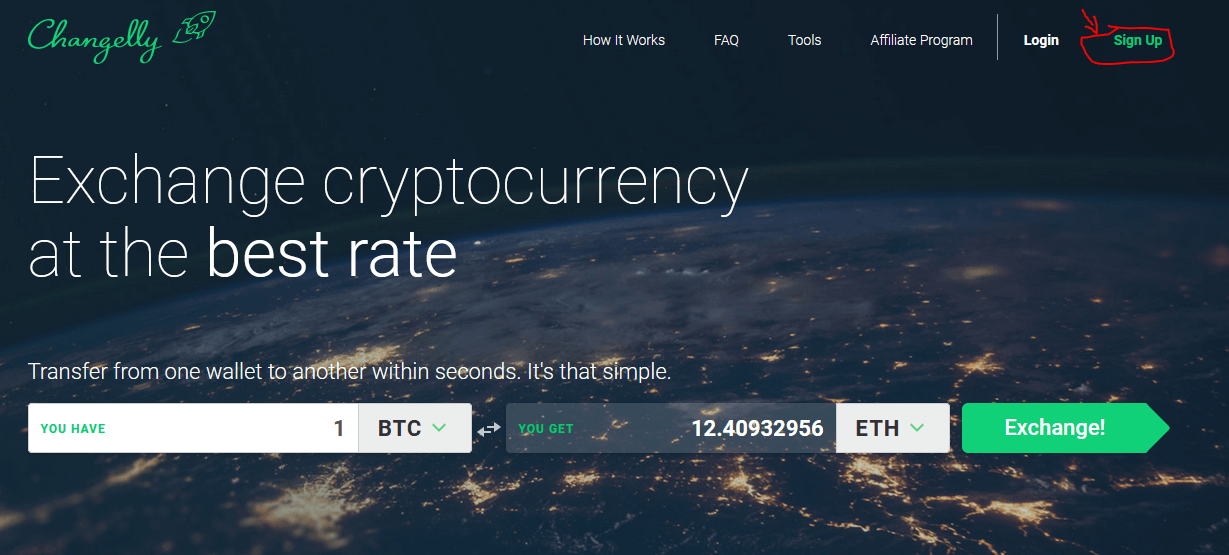

A year ago, the average human did not know what cryptocurrency was. The market was limited mostly to a techy crowd of developers and very early adopters, considering Bitcoin was the only major currency on the block back then. But thanks to a number of really smart entrepreneurs, rising prices, and a powerful community, everything is changing and crypto is going mainstream.

Entire governments, such as China's, are considering utilizing a national digital currency. Even the president of Russia, Vladimir Putin, met with the founder of Ethereum, Vitalik Buterin. All of this good press and positive outlook has caused many billions of dollars to be added to the market in the last year.

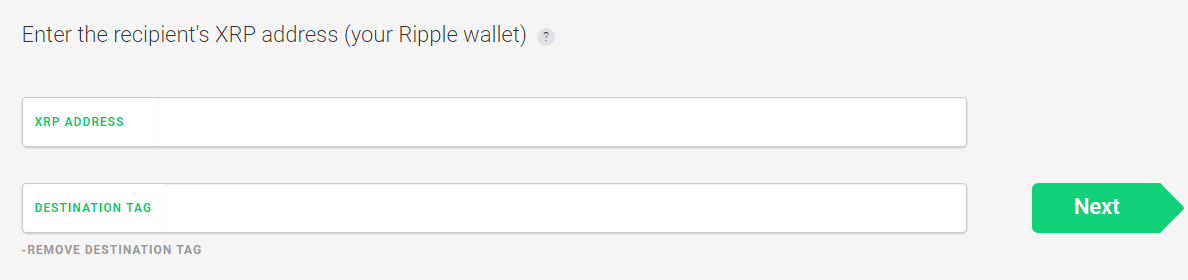

Ethereum, Litecoin, EOS and others are leading the charge of the technological revolution that is blockchain. Cryptocurrency-based crowdfunding known as Initial Coin Offerings (ICOs) are also a major player in the revolution. Blockchain startups like The Bancor ICO raised $153 million dollars in a matter of a few hours. This new wave of Blockchain startups, such as Sia's Storage Platform e.g. leverages underutilized hard drive capacity. If they are even remotely successful, we are looking at many 10s if not 100s of billions of dollars being added to the overall cryptocurrency market as they continue to grow.

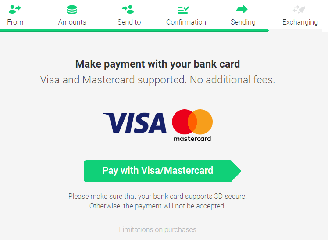

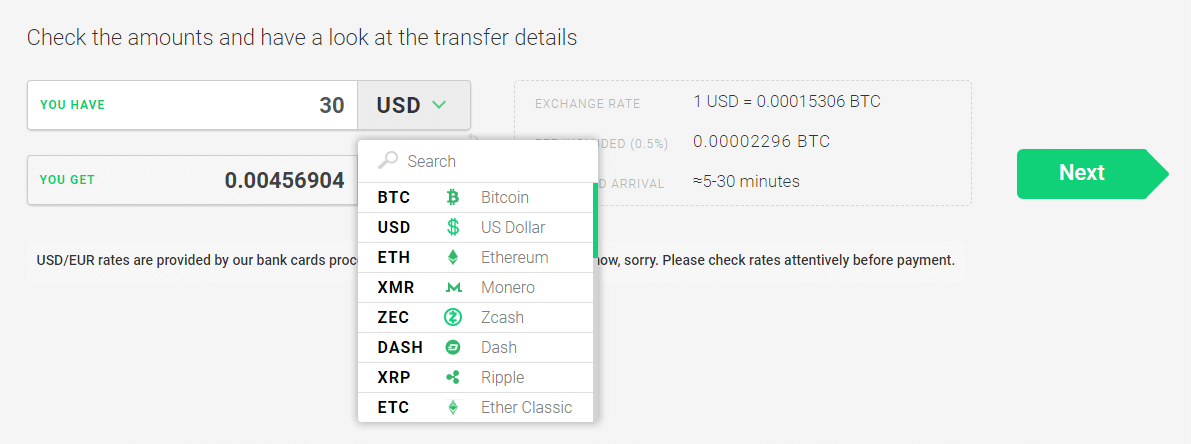

Current blockchains, such as Bitcoin and Ethereum, can only process ten’s of transactions per second while other mainstream payment process systems, such as Visa or Mastercard are able to process thousands of transactions per second. Undoubtedly, a scalable version of blockchains like Ethereum would make cryptocurrency the payment method of choice and project it into the mainstream.

The cryptocurrency market can seem volatile compared to traditional markets. There is more up and down movement, but the general trend line is a strong uptrend. A lot of people believe Ethereum alone will be worth over $1,500 a token in the next year or two. That will drive the prices of many other currencies up a lot.

In the future, Ethereum could be more of the market indicator than Bitcoin currently is. Meaning, if Ethereum goes up, everything else tends to go up, which has been the case for Bitcoin recently, as it tends to control the market.

The market as a whole has been particularly stable in recent weeks. Ethereum was worth as much as $620 a token and as little as the $580 range in the last few weeks. But the strength of the market really shines when the $580 "drop" happened and it quickly re-tested $620 multiple times and showed that $580 was the current floor price. This creates a sense of security in the market and helps people believe in it more long term when they see these quick rebounds from drops in price.

Entire governments, such as China's, are considering utilizing a national digital currency. Even the president of Russia, Vladimir Putin, met with the founder of Ethereum, Vitalik Buterin. All of this good press and positive outlook has caused many billions of dollars to be added to the market in the last year.

|

| Bitcoin May Be Down, But It's Actually Ahead of Schedule to Hit $1 Million by 2020 |

The excitement about the cryptocurrency market has attracted a lot of entrepreneurs who are looking to disrupt big industries through Blockchain technology.

Ethereum, Litecoin, EOS and others are leading the charge of the technological revolution that is blockchain. Cryptocurrency-based crowdfunding known as Initial Coin Offerings (ICOs) are also a major player in the revolution. Blockchain startups like The Bancor ICO raised $153 million dollars in a matter of a few hours. This new wave of Blockchain startups, such as Sia's Storage Platform e.g. leverages underutilized hard drive capacity. If they are even remotely successful, we are looking at many 10s if not 100s of billions of dollars being added to the overall cryptocurrency market as they continue to grow.

Current blockchains, such as Bitcoin and Ethereum, can only process ten’s of transactions per second while other mainstream payment process systems, such as Visa or Mastercard are able to process thousands of transactions per second. Undoubtedly, a scalable version of blockchains like Ethereum would make cryptocurrency the payment method of choice and project it into the mainstream.

The cryptocurrency market can seem volatile compared to traditional markets. There is more up and down movement, but the general trend line is a strong uptrend. A lot of people believe Ethereum alone will be worth over $1,500 a token in the next year or two. That will drive the prices of many other currencies up a lot.

In the future, Ethereum could be more of the market indicator than Bitcoin currently is. Meaning, if Ethereum goes up, everything else tends to go up, which has been the case for Bitcoin recently, as it tends to control the market.

The market as a whole has been particularly stable in recent weeks. Ethereum was worth as much as $620 a token and as little as the $580 range in the last few weeks. But the strength of the market really shines when the $580 "drop" happened and it quickly re-tested $620 multiple times and showed that $580 was the current floor price. This creates a sense of security in the market and helps people believe in it more long term when they see these quick rebounds from drops in price.